Table of Contents

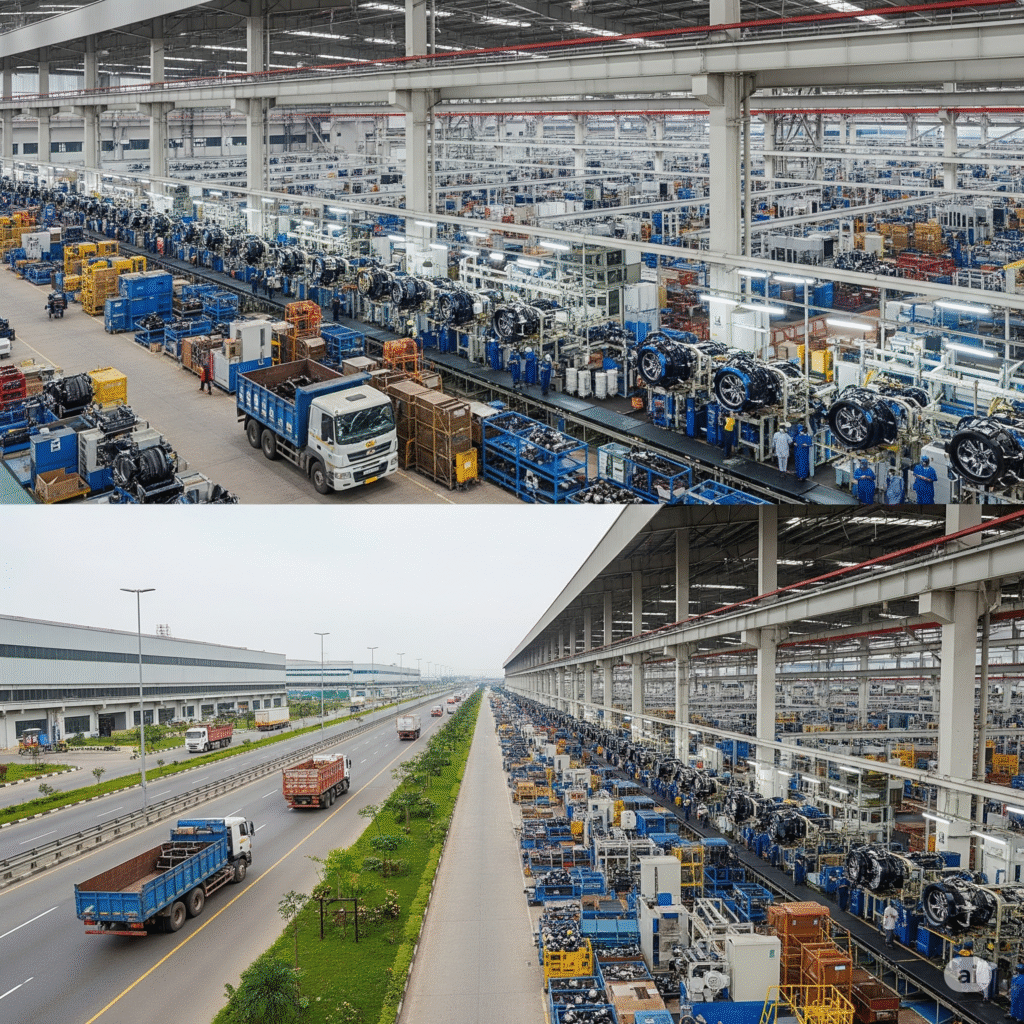

Introduction: The Rise of Nigerian Manufacturing States

Nigeria’s manufacturing sector is undergoing a powerful transformation — one driven not just by multinational giants but also by the steady rise of local industries and regional production zones. Across the country, several Nigerian manufacturing states are emerging as economic engines, powering industrial growth and shaping the future of commerce in Africa.

While oil has long dominated the Nigerian economy, the focus is now shifting toward non-oil sectors — and manufacturing is leading the way. From cement and food processing to textiles and pharmaceuticals, Nigerian manufacturing states are becoming magnets for innovation and investment.

This surge is not accidental. Strategic infrastructure projects, improved access to power, and a growing demand for locally made goods are helping certain states outperform others.

In this blog, we’ll highlight the top 5 powerful Nigerian manufacturing states, explaining why they lead, what they offer, and what their rise means for businesses across the continent. If you’re looking to source goods or expand industrial partnerships, these are the states to watch.

Why Manufacturing Matters for Nigeria’s Economy

The importance of manufacturing in Nigeria cannot be overstated. It’s not just a sector—it’s the engine driving economic growth, job creation, and long-term stability. For Nigerian manufacturing states, this sector plays a defining role in positioning them as economic leaders within the country and across West Africa.

Over the past few years, manufacturing has contributed consistently to Nigeria’s GDP, averaging around 9%. More than just numbers, this sector supports millions of jobs and creates opportunities for value-added production across food, textiles, cement, pharmaceuticals, and more.

For many Nigerian manufacturing states, the presence of industrial parks, increased local demand, and infrastructure development have created a foundation for sustainable economic growth. The Manufacturers Association of Nigeria (MAN) even projects that if properly supported, the sector could contribute up to 20% of national GDP by 2030.

In short, strengthening manufacturing is essential—not only for Nigeria’s future but also for the continued rise of the most powerful Nigerian manufacturing states.

Criteria for Ranking the Top Manufacturing States

To identify the most powerful Nigerian manufacturing states, it’s essential to look beyond just production figures. The strength of a manufacturing state depends on a combination of factors that together create an environment where industries can thrive and grow sustainably.

Industrial output and diversity measures not only how much a state produces but also the variety of products manufactured. A diverse manufacturing base—ranging from textiles and food processing to chemicals and building materials—signals resilience and economic strength.

Infrastructure and logistics are vital for smooth operations. Reliable electricity, good road networks, access to rail and ports, and functional industrial parks ensure manufacturers can operate efficiently without costly delays or interruptions.

Investment climate reflects government support and business friendliness. States that offer incentives, streamlined regulatory processes, and attract foreign and local investment create a fertile ground for industry expansion.

Workforce availability and skills matter because manufacturing requires trained personnel. States with vocational training centers, technical schools, and a skilled labor pool can better meet the evolving needs of manufacturers.

Finally, strategic location plays a key role. States near major consumer markets or export hubs have a natural advantage in reducing transport costs and improving supply chain efficiency.

Together, these criteria highlight which Nigerian manufacturing states have the best foundations for sustained industrial growth.

Lagos State – Nigeria’s Manufacturing Powerhouse

Lagos State firmly holds its position as the leader among Nigerian manufacturing states, often called the economic heartbeat of Nigeria. It accounts for approximately 30% of Nigeria’s Gross Domestic Product (GDP) and an impressive 60% of the country’s industrial activities. The manufacturing sector alone contributes nearly 30% to Lagos’s GDP, highlighting its central role in driving economic growth. Beyond manufacturing, Lagos generates about 65% of Nigeria’s Value Added Tax (VAT) and handles 90% of the nation’s foreign trade, underscoring its dominance in commercial activities.

Key to Lagos’s manufacturing success are its robust industrial hubs and infrastructure. The Lekki Free Zone (LFZ) is a flagship industrial area offering significant incentives, such as tax holidays and customs duty exemptions. This zone attracts multinational companies operating in manufacturing, logistics, oil, and gas, aiming to boost economic diversification and international trade.

The Ikeja and Agbara Industrial Estates house a diverse mix of industries—from food processing and pharmaceuticals to electronics—drawing both local and foreign investment. Recently, the opening of the Lekki Deep Sea Port in 2023, the largest in Nigeria and one of West Africa’s biggest, has further strengthened Lagos’s logistics and distribution capabilities, enabling efficient trade across the continent.

Lagos is also home to several prominent manufacturing companies that have shaped its industrial landscape. The Dangote Group, with its cement production, sugar refining, and flour milling operations, plays a major role. Other key players include Nigerian Breweries Plc, Nestlé Nigeria Plc, and Unilever Nigeria Plc, all of which manufacture a wide range of food, beverage, and consumer goods products.

Sustainability is becoming a growing focus. The “Eco Circulate” campaign, launched in 2024, promotes a circular economy by transforming waste into resources. This initiative encourages manufacturers in Lagos to adopt eco-friendly practices, driving cost savings and operational efficiency while contributing to environmental protection.

Despite challenges like traffic congestion and high costs, Lagos’s unrivaled market access, strong infrastructure, and diverse industrial base make it the undisputed powerhouse among Nigerian manufacturing states, a magnet for investors and manufacturers alike.

Ogun State – The Fastest Growing Manufacturing Hub

Ogun State has rapidly emerged as one of the most powerful Nigerian manufacturing states, second only to Lagos in industrialization. Boasting over 6,000 industries, it is a vital contributor to Nigeria’s manufacturing sector, with key industries spanning cement production, agro-processing, steel manufacturing, and consumer goods. Prominent companies such as Dangote Cement, Lafarge, Nestlé, Unilever, Procter & Gamble, and Coleman Cables operate within the state, reflecting its diverse industrial landscape.

Infrastructure development is a cornerstone of Ogun’s rise as a manufacturing powerhouse. The Gateway International Agro-Cargo Airport in Ilishan-Remo stands out with the longest runway and largest apron in Nigeria, enhancing the export potential for agricultural and industrial products and positioning the state as a crucial logistics hub in West Africa. Similarly, the newly inaugurated Inland Dry Port at Papalanto, opened in October 2024, alleviates congestion at Lagos ports by providing efficient cargo handling facilities, which directly supports industrial growth.

Ogun’s progress is further bolstered by strong public-private partnerships. The Remo Economic Industrial Cluster, developed in collaboration with ARISE Integrated Industrial Platforms, spans 6,300 hectares in Sagamu. Phase I alone is expected to attract around $1 billion in foreign direct investment and create approximately 32,000 jobs, underscoring the state’s industrial ambitions. Meanwhile, the Dangote Group’s expansion with a 6 million metric tons per annum cement plant in Itori complements its existing facilities, positioning Ogun as the largest cement-producing region in Sub-Saharan Africa.

Economically, Ogun’s industrialization has translated into significant job creation, with projections estimating between 30,000 and 50,000 new jobs in the near future. Looking ahead, plans to develop the Olokola Deep Seaport and the Remo Economic Zone as Special Economic Zones with Free Trade status signal continued growth and increasing competitiveness.

In summary, strategic investments, infrastructural advancements, and robust partnerships have cemented Ogun State’s role as one of the most dynamic and powerful Nigerian manufacturing states, poised for sustained industrial leadership in the region.

Rivers State – The Oil & Manufacturing Nexus

Rivers State, located in Nigeria’s resource-rich Niger Delta, plays a critical role as a nexus between the nation’s vast oil wealth and its manufacturing sector. It contributes over 40% of Nigeria’s onshore crude oil production and is the country’s sole exporter of liquefied natural gas (LNG), making it indispensable to Nigeria’s energy economy.

The state hosts vital oil and gas infrastructure, including the two major refineries in Eleme, the Bonny LNG plant, and the Onne Oil and Gas Free Zone. These installations have attracted global oil giants such as Shell, TotalEnergies, and ExxonMobil. However, despite this strategic importance, the sector faces ongoing challenges, including pipeline vandalism and theft, which disrupt production and exports, impacting the local economy.

While Rivers State’s oil industry thrives, its manufacturing landscape has struggled in recent years. The once-bustling Trans-Amadi Industrial Layout, a key manufacturing hub, now contains many abandoned factories. The decline is attributed to infrastructural decay, rising operational costs, and security concerns that deter investors and manufacturers.

In response, the Rivers State government has launched several initiatives aimed at reviving its manufacturing sector and strengthening its position among powerful Nigerian manufacturing states. These efforts include offering attractive investment incentives such as tax holidays and simplified land acquisition processes to lure new investors.

Additionally, there is a focused drive on infrastructure revitalization, including improving industrial estates and enhancing transportation networks to ease the movement of goods and services. Public-private partnerships are also playing a significant role, with collaborations on projects like an aluminum rolling mill in the Ogoni region, aiming to diversify the economy beyond oil and rebuild manufacturing capacity.

These combined measures reflect Rivers State’s commitment to balancing its oil wealth with industrial growth, striving to reclaim its position as a key player among Nigeria’s manufacturing powerhouses.

Anambra State – A Surging Southeastern Giant

Anambra State, located in southeastern Nigeria, has rapidly emerged as one of the most powerful Nigerian manufacturing states, thanks to the industrious spirit of its people, strategic infrastructure development, and a supportive policy environment.

At the heart of this industrial surge is Nnewi, often called the “Japan of Africa.” This city is home to Innoson Vehicle Manufacturing (IVM), Nigeria’s first indigenous automobile producer. Founded by Chief Innocent Chukwuma, IVM manufactures cars, buses, and tricycles, with many components sourced locally. Nnewi also hosts other manufacturing giants such as Cutix Plc, Chicason Group, Ngobros Industries, and the Ibeto Group, all contributing to a robust industrial ecosystem in Anambra.

Under Governor Chukwuma Soludo’s leadership, Anambra has launched several ambitious projects. The Anambra Mixed-Use Industrial City (AMIC), a sprawling 4,000-hectare Special Economic Zone, integrates manufacturing, logistics, agriculture, and technology, supported by a $200 million investment agreement with Afreximbank. The state has also upgraded critical road networks and developed digital innovation hubs like the Solution Innovation District (SID) to empower youth and foster startups.

Agro-industrial initiatives, backed by a $100 million fund from the African Development Bank, focus on transforming the agricultural value chain with projects such as Agricultural Transformation Centers and a Special Agro-Processing Zone.

With over $500 million secured in recent investment commitments, Anambra is poised to solidify its place among Nigeria’s most powerful manufacturing states, blending industrial heritage with innovation and strategic development.

Kano State – The Traditional Manufacturing Hub

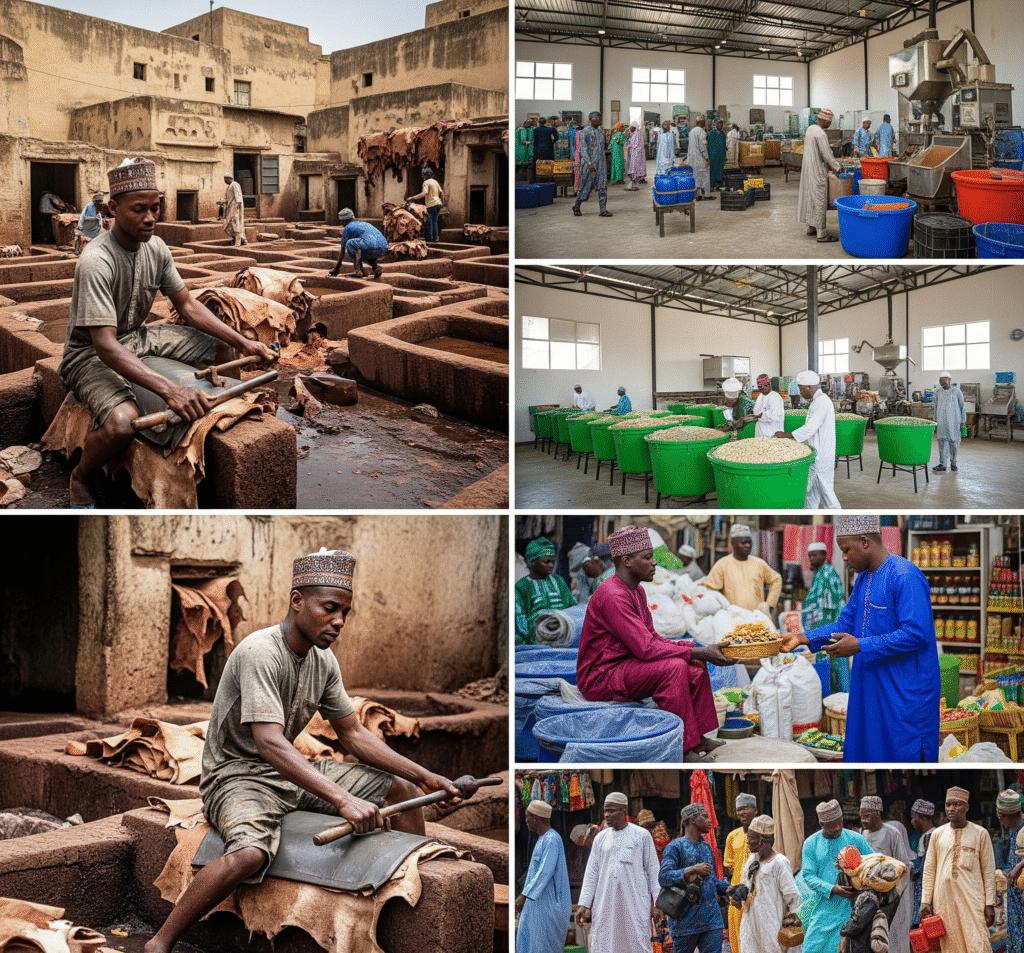

Kano State, often celebrated as Northern Nigeria’s industrial heartbeat, is one of the most enduring and powerful Nigerian manufacturing states. Its legacy in leatherworks, agro-processing, and textiles has shaped not only the regional economy but Nigeria’s manufacturing identity at large.

Historically, Kano stood as a centerpiece of manufacturing excellence. With industrial clusters like Sharada, Bompai, Challawa, and Tokarawa, the state hosts hundreds of factories producing textiles, plastics, cosmetics, ceramics, enamelware, pharmaceuticals, and furniture. These clusters continue to serve as innovation centers for small and medium-scale industries.

One of Kano’s crown jewels is its leather industry, which supplies some of the finest tanned hides for global export. Products such as shoes, belts, cushions, saddles, and bags are made from locally processed leather, contributing to Nigeria’s non-oil export revenue.

Kano’s strength in agro-processing is fueled by its rich agricultural base. Key crops include millet, cowpeas, groundnuts, chili, maize, and garlic. These feed into value-add industries that produce oils, spices, flour, and livestock feed—further reinforcing the state’s manufacturing power.

Strategically positioned, Kano connects to northern Nigerian states and countries like Niger and Chad via road, rail, and air. The Malam Aminu Kano International Airport, along with markets like Dawanau and Kurmi, cements the state’s role as a trade and logistics giant.

In every sense, Kano remains a resilient force among Nigerian manufacturing states, blending history, commerce, and innovation.

Challenges Facing Nigerian Manufacturing States

Nigeria’s manufacturing sector faces a myriad of obstacles that stifle its growth. Unreliable electricity forces manufacturers to rely on costly diesel generators, pushing energy costs to over 40% of total production. Foreign exchange volatility, with the naira reaching ₦1,710/$ in late 2024, has driven up the cost of imported machinery and raw materials. High interest rates (20%+) and tough lending conditions limit SMEs’ access to capital. Poor infrastructure, port congestion, and multiple taxation layers further compound operational difficulties. Policy inconsistency and regulatory overlaps deter investment, while inflation has reduced consumer demand and led to a buildup of unsold goods. Additionally, skilled labor shortages and poor-quality control compliance challenge both local competitiveness and export ambitions. Strategic reforms are urgently needed.

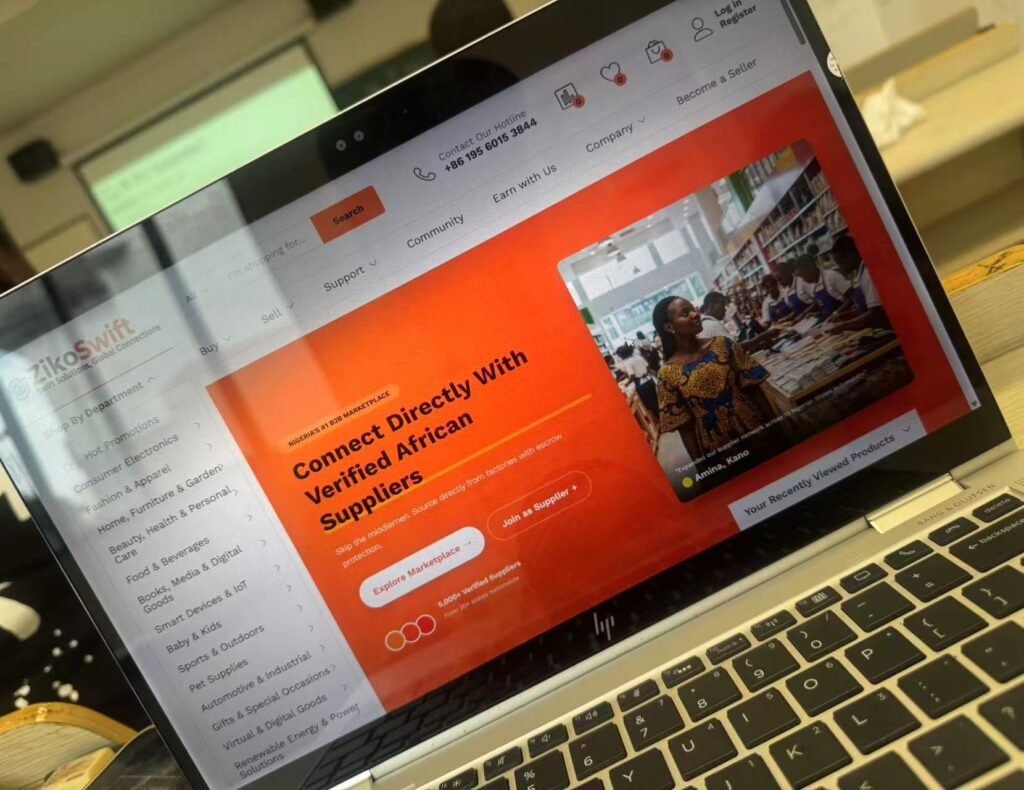

How ZikoSwift Supports Growth in Nigerian Manufacturing States

ZikoSwift is a Nigerian-based B2B marketplace that connects verified African manufacturers directly with global buyers, aiming to streamline the sourcing process and accelerate industrial growth across Nigeria’s manufacturing hubs.

🔍 Key Contributions to Nigerian Manufacturing

Industry Education and Advocacy

Through informative content, ZikoSwift addresses real manufacturing challenges—like power shortages, infrastructure gaps, and regulatory hurdles—while providing insights to help businesses adapt and grow.

Direct Access to Verified Manufacturers

ZikoSwift eliminates intermediaries by offering direct access to trusted, vetted Nigerian manufacturers. This builds transparency, reduces costs, and fosters stronger trade relationships.

Escrow Payment Protection

To reduce fraud and build global trust, ZikoSwift implements a secure escrow system—ensuring funds are only released after product delivery is confirmed. This gives international buyers confidence in sourcing from Nigerian suppliers.

Global Shipping and Logistics Support

The platform assists manufacturers with logistics and cross-border shipping, helping them access international markets efficiently while reducing the friction of export processes.

🌍 Empowering Local Economies

By providing visibility, secure trade tools, and access to global demand, ZikoSwift fuels the expansion and modernization of manufacturing across Nigerian states—boosting employment, innovation, and economic resilience around Africa.

Future Outlook: What Lies Ahead for Nigerian Manufacturing States

Nigeria’s manufacturing sector in 2025 stands at a crucial crossroads, balancing persistent challenges with promising opportunities. Economic reforms aimed at stabilizing exchange rates, reducing inflation, and improving access to affordable financing will be key drivers of sector growth. The Central Bank of Nigeria’s Electronic Foreign Exchange Matching System (EFEMS) is expected to enhance currency stability, boosting investor confidence.

Technological advancements, including Industry 4.0 innovations like AI, robotics, and automation, offer significant potential to increase productivity and optimize operations. However, high investment costs and workforce skill gaps remain obstacles.

The African Continental Free Trade Area (AfCFTA) opens vast regional markets for Nigerian manufacturers, promoting exports through preferential tariffs and enhanced trade cooperation. To fully benefit, manufacturers must improve product quality and overcome non-tariff barriers.

Despite ongoing infrastructure and energy challenges, public-private partnerships and government initiatives aim to improve logistics and power supply.

ZikoSwift plays a pivotal role by connecting verified Nigerian manufacturers to global buyers, streamlining sourcing, and facilitating access to new markets. Through its platform, ZikoSwift supports the adoption of modern business practices and helps manufacturers leverage regional and international opportunities.

Conclusion: Unlocking the Potential of Nigerian Manufacturing States

Nigerian manufacturing states hold immense potential to drive the country’s economic diversification and industrial growth. Despite facing challenges such as infrastructure deficits, energy shortages, and regulatory complexities, focused efforts on reform, innovation, and investment are beginning to bear fruit. The emergence of digital platforms like ZikoSwift further empowers manufacturers, suppliers, and buyers by providing transparent, efficient, and secure avenues for business growth and global market access.

To fully unlock this potential, manufacturers must embrace modernization, improve product quality, and leverage technology. Suppliers and buyers are encouraged to engage actively with platforms like ZikoSwift to tap into verified networks that streamline sourcing and foster trust.

Together, through collaboration and innovation, Nigerian manufacturing states can transform into thriving industrial hubs that compete on the global stage. Join ZikoSwift today to be part of this transformative journey—connecting African manufacturing excellence with the world.